CrediVault develops financial applications that leverage blockchains in order to prevent financial fraud.

Records can be easily manipulated or accessed without authorization, posing significant risk to stakeholders. More than 80% of U.S. companies have been hacked in attempts to steal, change or publicize important data.

Failure to comply with government regulations can result in significant risks and legal consequences. Lack of automation and unaligned legacy systems fuel human error and inaccurate data.

Records lacking security can lead to unscrupulous actions, costing businesses and consumers time, money, and confidence. $10B lost to wire fraud annually in U.S. alone.

Records can be easily manipulated or accessed without authorization, posing significant risk to stakeholders. More than 80% of U.S. companies have been hacked in attempts to steal, change or publicize important data.

Failure to comply with government regulations can result in significant risks and legal consequences. Lack of automation and unaligned legacy systems fuel human error and inaccurate data

Records lacking security can lead to unscrupulous actions, costing businesses and consumers time, money, and confidence. $10B lost to wire fraud annually in U.S. alone.

Unaligned systems result in costly and inefficient data management.

Lack of transparency and control exposes organizations to legal and reputational risks.

Unsecured and non-compliant systems enable fraud and corruption.

Lack of transparency and security creates distrust among consumers.

Mishandled data and security breaches threaten brand reputation.

Traditional data centers are expensive to maintain and lack scalability.

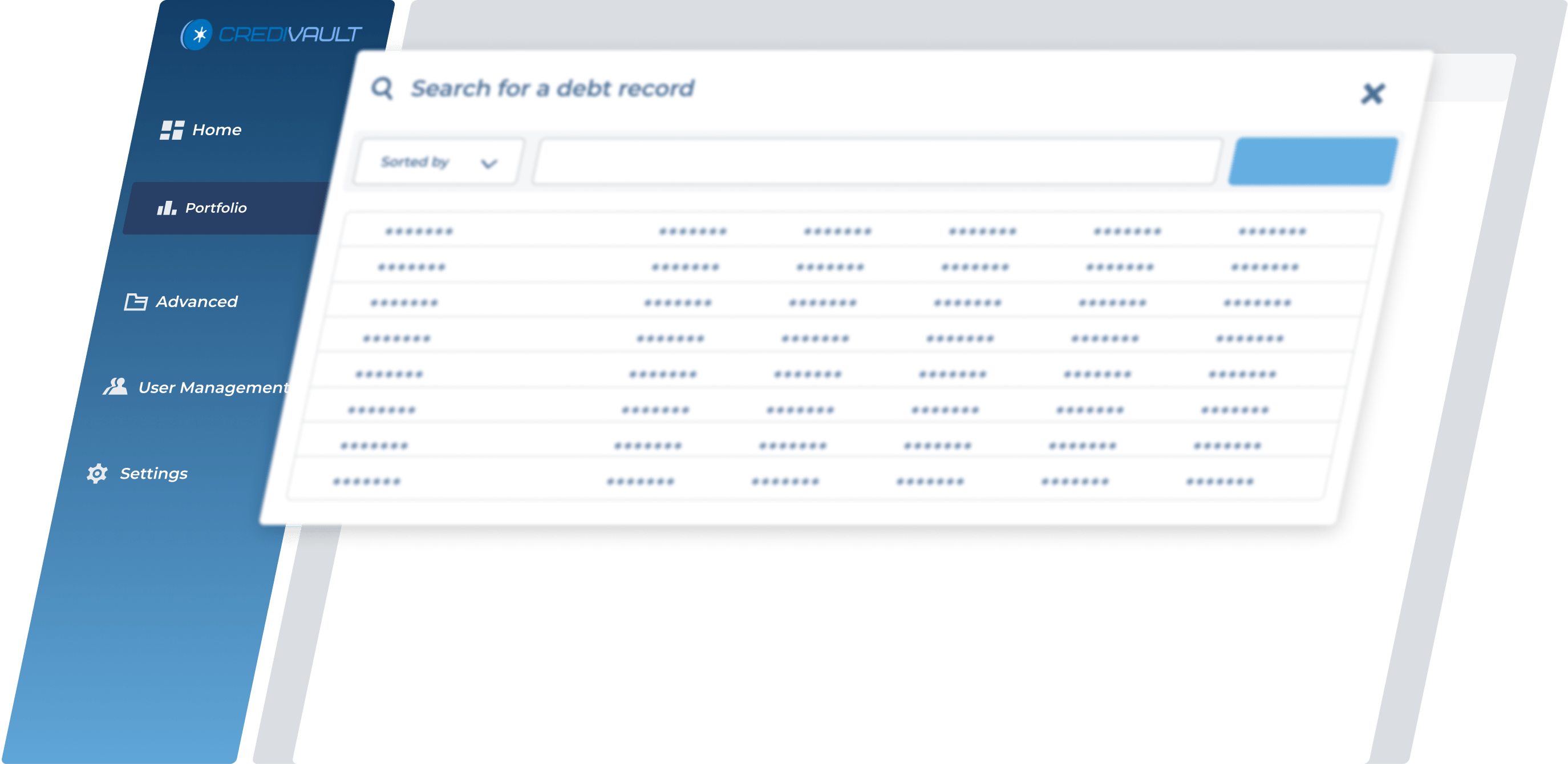

We build trust among citizens, businesses, and regulators by providing the ability to register tamper-proof and transparent digital transactional records so that no party can be exploited by fraud or human error. We have three RegTech/FinTech products that all leverage CrediVault’s core blockchain technology to address specific applications.

Encrypted databases, flexible and secure permission management, low latency of transaction confirmation, and high performance ensure full control over information.

CrediVault is crash fault tolerant, follows a “Chaincode is Law” principle, groups blocks into immutable chains, and encodes entire transaction histories.

All data entered into the system is verified by CrediVault’s validation engine minimizing human error and data integrity. Rogue intentions are recorded and recoverable.

Communication channels are secured with tunnel encryption eliminating unauthorized access and Hyperledger Fabric protects sensitive data.

Tamper-proof critical information is permanently stored on distributed private ledger

Empowers consumers to take control of their own records and transactions

Existing software tools can integrate CrediVault in their workflow

Business, buyer or manager loads data in existing software and uploads data to blockchain ledger (manually or automatically) through API

CrediVault helps increase consumer trust and confidence, enforce anti-fraud and implement anti-corruption practices, and big data applications.

CrediVault helps businesses overcome issues related to data security, compliance, and fraud that lead to consumer distrust, and reputational damage.

Gain transparency, accuracy, and data security with CrediVault. Verify information, initiate disputes, and make payments securely.

From Fraud to Trust: How CrediVault is Delivering Real Results

CrediVault is more than just ground-breaking technology. Our team and partnerships set us apart and open doors.

Our team is comprised of internationally networked committed change makers, former regulators and diplomats, engineers and seasoned business professionals. Our affiliations with Ernst & Young, Hyperledger, Endeavor Global and the U.S. and Israeli startup ecosystems provide us access to customers, talent, mentors and influencers.

CrediVault is more than just ground-breaking technology. Our team and partnerships set us apart and open doors.

Our team is comprised of internationally networked committed change makers, former regulators and diplomats, engineers and seasoned business professionals. Our affiliations with Ernst & Young, Hyperledger, Endeavor Global and the U.S. and Israeli startup ecosystems provide us access to customers, talent, mentors and influencers.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

John B.

CEO, Firefly

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

John B.

CEO, Firefly

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

John B.

CEO, Firefly

Start your journey towards securing your most critical information

21550 Biscayne Blvd Ste 400

Aventura, FL 33180

© 2023 CrediVault